Discover the most effective Medicare Supplement Plans for Your Insurance Coverage Needs

In the realm of healthcare insurance coverage, the quest for the optimal Medicare supplement plan tailored to one's details needs can usually feel like navigating a labyrinth of choices and factors to consider (Medicare Supplement plans near me). With the complexity of the medical care system and the variety of available strategies, it is critical to approach the decision-making process with an extensive understanding and critical frame of mind. As individuals get started on this journey to secure the finest protection for their insurance coverage requires, there are essential aspects to ponder, contrasts to be made, and specialist pointers to discover - all essential aspects in the mission for the ideal Medicare supplement strategy

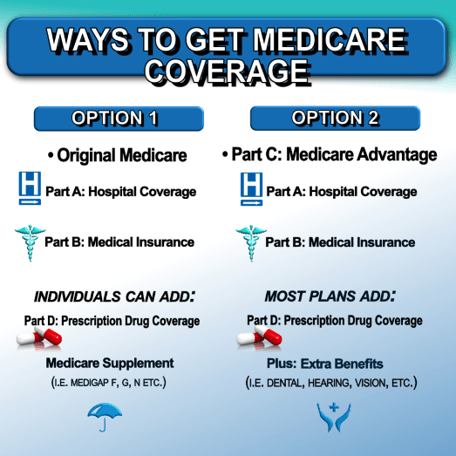

Understanding Medicare Supplement Plans

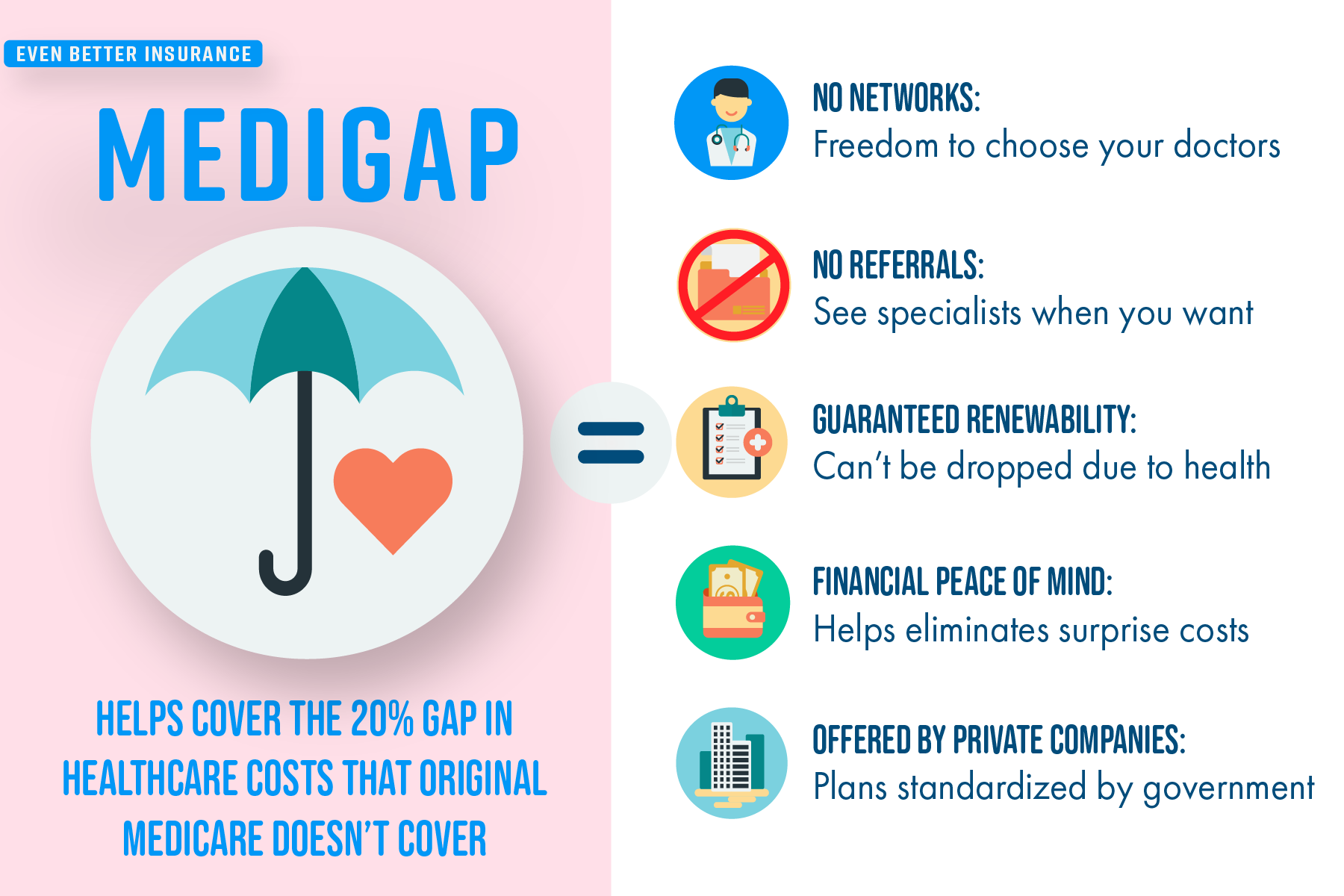

Recognizing Medicare Supplement Program is essential for people seeking added insurance coverage past what initial Medicare provides. These plans, additionally called Medigap policies, are used by private insurance provider to aid pay for health care costs that initial Medicare does not cover, such as copayments, coinsurance, and deductibles. It's critical to keep in mind that Medicare Supplement Program can just be acquired if you already have Medicare Component A and Part B.

One key aspect of recognizing these strategies is realizing that there are various standardized Medigap plans offered in most states, identified A with N, each supplying a different set of fundamental advantages. Strategy F is one of the most thorough strategies, covering almost all out-of-pocket costs that Medicare doesn't pay. On the various other hand, Strategy A supplies less advantages but may come with a lower premium.

To make an educated decision regarding which Medicare Supplement Strategy is appropriate for you, it is very important to consider your healthcare needs, spending plan, and coverage preferences. Consulting with an accredited insurance agent or checking out on-line resources can help you navigate the complexities of Medicare Supplement Plans and select the ideal alternative for your private conditions.

Factors to Take Into Consideration When Selecting

Having a clear understanding of your health care requirements and financial capacities is critical when considering which Medicare Supplement Plan to pick. Think about elements such as prescription medicine coverage, physician gos to, and any kind of potential surgical treatments or therapies.

One more vital element to take into consideration is the plan's insurance coverage choices. Various Medicare Supplement Plans offer differing levels of protection, so make certain the plan you select straightens with your specific medical care demands. In addition, consider the online reputation and financial stability of the insurance policy company providing the strategy. You desire to select a supplier that has a solid performance history of customer fulfillment and prompt cases processing.

Contrasting Different Strategy Alternatives

When reviewing Medicare Supplement Plans, it is necessary to compare the different plan options available to identify the very best fit for your health care requirements and monetary circumstance. visit here To begin, it is important to comprehend that Medicare Supplement Plans are standardized across most states, with each plan classified by a letter (A-N) and offering various degrees of protection. By comparing these plans, individuals can evaluate the coverage provided by each plan and pick the one that ideal fulfills their details demands.

When contrasting various strategy alternatives, it is necessary to take into consideration variables such as month-to-month costs, out-of-pocket prices, insurance coverage advantages, service provider networks, and customer contentment ratings. Some strategies might offer more extensive protection however featured greater month-to-month premiums, while others might have lower costs however less benefits. By reviewing these elements and evaluating them against your healthcare needs and budget plan, you can make an informed choice on which Medicare Supplement Plan supplies one of the most value for your specific situations.

Tips for Locating the Right Protection

Following, study the available Medicare Supplement Plans in your location. Comprehend the coverage given by each plan, consisting of deductibles, copayments, and coinsurance. Contrast the benefits offered by various plans to identify which straightens finest with your healthcare top priorities.

Consult from insurance policy agents or brokers specializing in Medicare strategies - Medicare Supplement plans near me. These professionals can give useful insights into the subtleties of each plan and aid you in choosing one of the most suitable insurance coverage based on your specific situations

Last but not least, evaluation consumer feedback and scores for Medicare Supplement Plans to assess overall contentment levels and determine any persisting issues or worries. Utilizing these ideas will assist you browse the complicated landscape of Medicare Supplement Program and discover the insurance coverage that ideal suits your demands.

How to Enroll in a Medicare Supplement Plan

Enlisting in a Medicare Supplement Plan entails a simple procedure that calls for careful consideration and documents. The first action is to guarantee qualification by being enlisted in Medicare Component A and Part B. Once eligibility is verified, the following action is to study and contrast the available Medicare Supplement Plans to discover the article source one that ideal fits your medical care needs and budget.

To register in a Medicare Supplement Plan, you can do so throughout the Medigap Open Registration Duration, which begins the initial month you're 65 or older and enlisted in Source Medicare Component B. Throughout this duration, you have ensured problem legal rights, indicating that insurer can not refute you insurance coverage or cost you greater costs based upon pre-existing problems.

To enlist, just call the insurer using the desired strategy and complete the required paperwork. It's vital to examine all conditions before joining to guarantee you recognize the insurance coverage given. When registered, you can delight in the added benefits and satisfaction that feature having a Medicare Supplement Plan.

Conclusion

Finally, picking the most effective Medicare supplement strategy needs careful factor to consider of aspects such as protection options, prices, and carrier networks. By contrasting different strategy choices and assessing individual insurance policy demands, individuals can find one of the most appropriate coverage for their medical care demands. It is necessary to enroll in a Medicare supplement strategy that supplies detailed benefits and economic protection to ensure satisfaction in handling healthcare expenditures.